#What is Setu Insights?

Setu's Insights API gives you actionable insights from a customer's financial information, such as bank statements, about their income, expenditure and financial history.

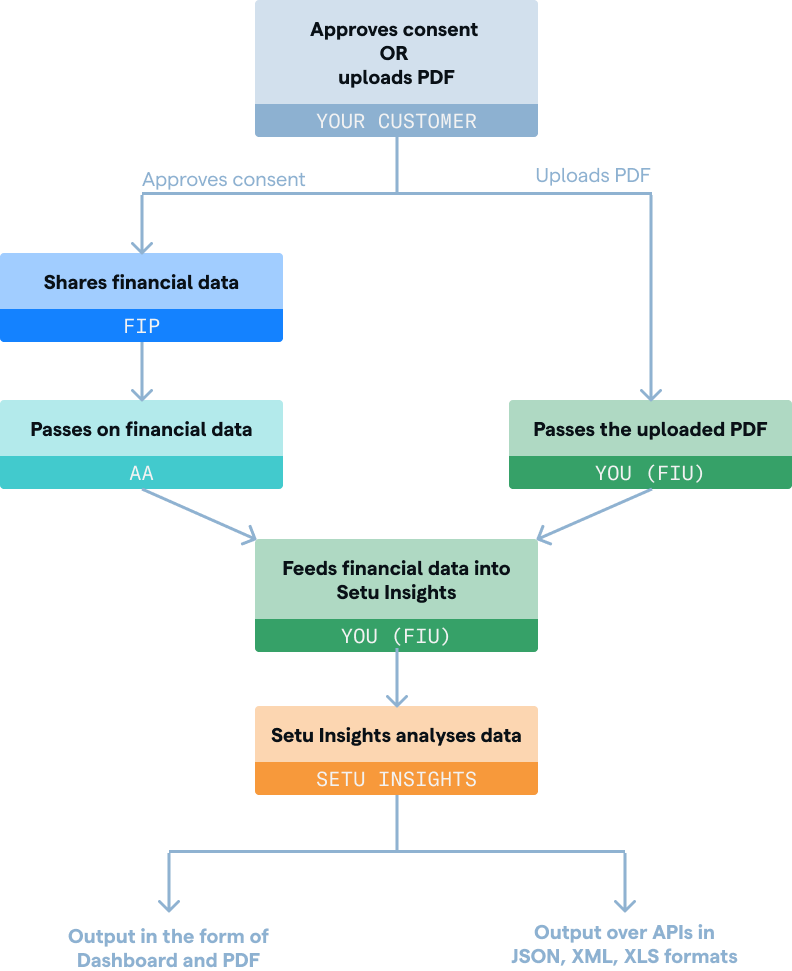

The Insights API consumes financial data uploaded via the Account Aggregator(AA) as well as external sources like PDF. The insights generated can be tailor-made to fulfill your specific requirements, ranging from underwriting use cases, to personal finance management.

Setu Insights provides output in various formats such as JSON, XML, XLS. Output in the form of dashboard will be made available soon.

#What can you do with this product?

With Setu Insights, you can analyse various financial statements like bank statements, equities, mutual funds, ETFs, GST returns, securities accounts etc. Some possible use-cases include—

- Income verification and underwriting—Verify applicant income and assess creditworthiness by analyzing bank statements. Extract income sources, evaluate financial stability and streamline the loan approval process.

- Loan monitoring—Monitor borrower's financial health and loan obligations. Track cash flow, identify irregularities and manage loan portfolios effectively. Stay proactive with real-time insights into borrower's ability to meet loan obligations and mitigate risks.

- Personal finance management and wealth management—Empower individuals to manage personal finances effectively. Categorise transactions, generate spending reports and gain insights to set financial goals and make informed decisions. For wealth managers, access holistic financial data to offer personalized advice and tailored investment strategies.

Setu Insights will support analysis of additional financial information such as Equities, Mutual Funds, ETFs, GST, ITR, Insurance etc., as and when these data types become available on AA.

#How does it work?

Feed data—Once your customer gives consent to access their financial data, the FIP shares the finance data with you (FIU), via the AA gateway. You feed this data into Setu Insights for analysis. Refer AA docs for a quick explanation of FIU, FIP, AA.

Analyse financial data—The raw data goes through a categorization model of Setu Insights and gets bucketed into various categories of incomes, expenses etc.

Get reports—Post analysis, the insights are provided to you in the format of your choice.

Was this page helpful?