#Account Aggregator

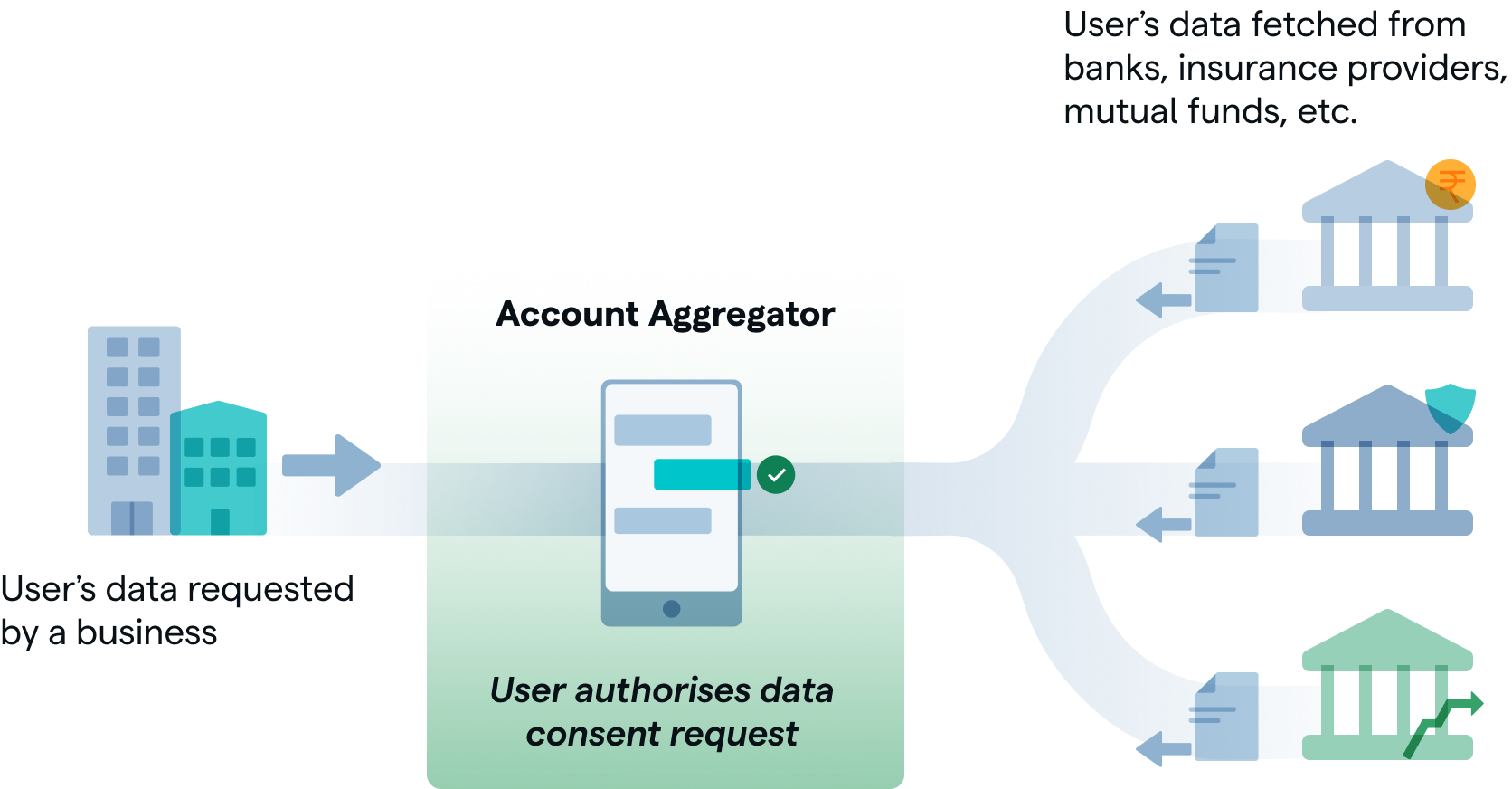

Account aggregators(AAs) are regulated entities that facilitate consented sharing of financial data by utilising the DEPA framework. They act as the bridge between data providers such as banks, and data consumers such as lenders—to enable the sharing of a user’s financial data based on their explicit consent. Setu currently provides AA-related services in close partnership with fully-licensed AAs.

Note—Setu’s AA gateway has introduced a powerful enhancement in the form of a multi-AA gateway. This lets you connect to multiple AAs, from which Setu’s smart routing framework dynamically selects the most performant one. This helps with higher conversions and better performance of your AA integration. Learn more about how to utilise multi-AA gateway.

Data providers are called Financial Information Providers (FIPs) and data consumers are called Financial Information Users (FIUs) in the AA ecosystem

For example, let’s say a lender wants to check the bank statements of a user to check their loan eligibility. Here’s how the AA handles it—

- The lender makes a data consent request, which is routed to the AA.

- The user receives a notification through the AA that the lender wants to access 3 months' bank statements.

- The user can decide to approve or reject the consent request.

- If they approve the request, the data is fetched from the FIP—in this case, the bank—and shared with the lender.

The consent request carries details about the type of data, how long the FIU needs it for, and how they plan to use it. The user can take into consideration all of these factors before deciding to approve or reject the request. The user can also decide to withdraw consent for a previously-approved request. This way, the user remains the custodian of their own data.

Already integrating? Checkout the AA Integration Guide here.

Try out our sample app built using Setu AA sandbox here

#What can you build?

Setu’s AA related services are powered by multiple licensed NBFC-AA partners. The AA framework opens up a lot of opportunities for FIU apps to build financial user journeys with seamless user consented data sharing.

This allows developers to build tech-first user applications and features powered by digital data sharing flows over conventional PDF documents upload. Some of the use cases worth exploring:

- Income Verification - Get access to users’ bank statements with their consents. While Setu AA ensures that the data payload remains standardised and error free, simplify your user verification process and improve conversion rates!

- Loan Monitoring - Monitor your borrower’s financial health after loan disbursal by analysing cash flow across a user’s bank accounts. As a lender, get early signals from a user's bank statements and prevent potential loan defaults.

- Personal Finance Management - Help your users make better financial decisions. Pull transactions, categorise and track spending patterns across multiple bank accounts and much more.

For more details, you can check out our AA use-case playbook

Get started with Setu's mock FIP that lets you receive financial data across multiple FI types. We will soon add the ability for you to configure custom mock data sources. If you would like to test this feature, please reach out to us at aa@setu.co.

#Building with Setu's AA stack

Setu currently provides building blocks for FIU applications in conjunction with our licensed AA partner. This includes:

- HTTP APIs

- Developers can call these APIs to create consent requests, test the approval or rejection of consent requests and fetch data for approved consent.

- End-user experience

- Carefully built screens that your users can use to approve or reject incoming consent requests

- This UI is built to be embeddable inside web and native mobile apps

Please check Setu Insights to get actionable insights from a customer's bank statement.